Every new trader, starting his journey in the world of cryptocurrencies, makes the same mistakes. The easiest way for new traders to minimize their losses and maximize profits is to learn from the mistakes of others and do their research before diving into investing.

If you are new to the world of cryptocurrencies and are looking for a crypto platform with low fees, personalized customer support and an easy-to-use interface, consider developing a turnkey cryptocurrency trading platform. The cost of a cryptocurrency exchange depends on the functionality and technical characteristics, as well as the individual characteristics of the customer and georeferencing.

Below are the most common mistakes that beginner cryptocurrency traders should avoid.

Wrong choice of cryptocurrency exchange platform

Before you start trading, you need to choose a cryptocurrency exchange to register with. Unfortunately, many beginners rush this first step, and it can be very costly.

Here are some important points to consider when choosing the right exchange for your individual needs:

- simplicity and convenience of the platform;

- wide selection of cryptocurrencies;

- low commissions and good asset prices;

- authenticity and security of the platform;

- educational content;

- reliable and personalized customer support;

- regularly updated security system and cold, offline storage;

- assessment of the value of a cryptocurrency exchange;

- useful trading functions.

Platform security is important, low fees will save you serious money, and the personal support team will give you the advice and assistance you need to become a successful and well-informed trader from the very beginning.

Also, be sure to choose a cryptocurrency exchange that has a wide selection of coins and a user-friendly interface – not all cryptocurrency platforms are easy to use, and this can be a major problem if you’re still getting the hang of it. For example, the cost of the cryptocurrency exchange from Merehead is influenced by such factors as security and speed of response to user requests.

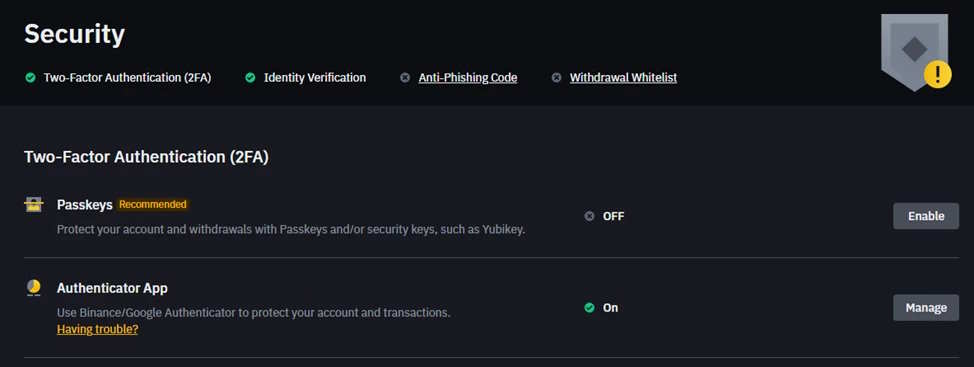

Security of the crypto exchange

Although the world of cryptocurrencies has become much safer over the past decade, trading cryptocurrencies still involves some security risks.

Make sure you choose an exchange that has:

- two-factor verification (2FA) is a great first step to avoid password hacking;

- a storage system that places most assets in cold, offline storage;

- a complex multi-level security system that is regularly updated to combat the latest threats and hacks;

- full transparency of the location and people who run the company.

It is also important to be aware of possible scams and scams. The most common ones include insecure exchanges, fake coins, email scams, and password hacking.

Avoid clicking on links or attachments from unknown email senders to avoid falling victim to various types of cryptocurrency phishing scams. Please note that an open-source crypto exchange solution has more vulnerabilities than a project developed by an experienced company.

Recently, a number of AI-driven crypto platforms like Immediate X2 Urex have taken to the field to allow people new options for leveraged trading.

Also, when discussing crypto investments on online forums and social media, avoid being too vocal about your holdings.

Lack of knowledge about what a good investment looks like

When it comes to investing in cryptocurrencies, you can’t get very far without knowing what a good cryptocurrency investment looks like.

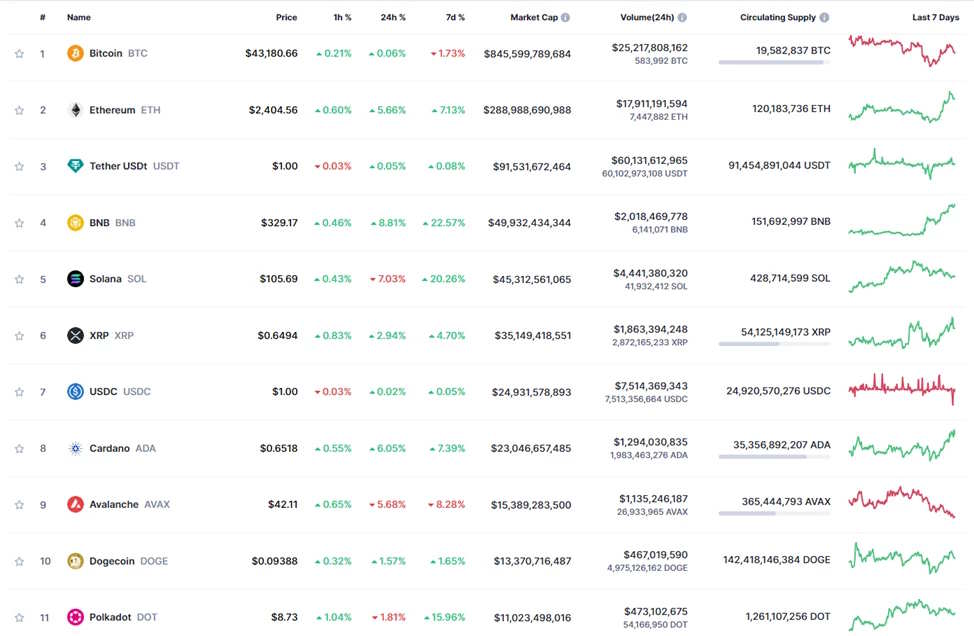

In such a competitive market, for a cryptocurrency to outperform all others, it must have a unique feature or be a significant improvement on existing technology. A cryptocurrency’s ability to solve a problem in the world is what determines whether it will be successful in the long term. Additionally, when valuing a cryptocurrency, there are other factors to consider besides the price of the coin.

By making sure that the project is backed by trusted and reputable names, you will prevent yourself from making costly mistakes when purchasing coins that are well advertised but never actually make it to market.

Lack of portfolio diversification

If you’re looking to reduce risk and maximize returns, it’s a good idea to spread your investments across different cryptocurrencies (and other types of investments).

This is much more effective than investing in just one coin, as there is less chance of all cryptocurrencies crashing at the same time. You can develop a strategy that suits your trading style, risk tolerance and goals.

As a general rule, it is recommended to combine the largest, most stable cryptocurrencies with some medium and small cryptocurrencies (by market capitalization).

If you are just starting to invest in cryptocurrencies, it is recommended to adhere to the 80/20 rule: a combination of large and medium-sized cryptocurrencies with small ones. This will also minimize any liquidity issues in your portfolio.

By following this rule, you will be able to profit significantly from any sudden surge in small- and mid-cap cryptocurrencies, with the majority of your investment going towards more stablecoins.

However, it’s important to note that while diversification is certainly a good thing, you shouldn’t spread yourself too thin across different assets. A common mistake newbies make is allocating small amounts to a variety of small altcoins instead of focusing on a handful of larger, stable, and established coins. Don’t invest in more coins than you can keep track of!

Constantly searching for the next Bitcoin or Ethereum

Much of the cryptocurrency hype of the last decade has been driven by coins like Bitcoin and Ethereum turning everyday people into millionaires overnight. While this can (and is) happening now, looking for the next Bitcoin or 1000X coin is not the best way to enter the world of cryptocurrencies.

Cryptocurrencies are one of the most profitable markets, but new traders should know that the vast majority of crypto coins fail before they really take off.

These days, there are thousands of altcoins to choose from, and everyone is confident that their project will be successful. Needless to say, this is not the case.

Of course, lucky breaks do happen and people do get rich overnight, but if you want to minimize risk and create a long-term trading strategy that will produce results, you need to give up the idea of committing yourself entirely to the next 1000X coin like Venus BNB on the screen.

A well-balanced, carefully researched portfolio is the best bet, and new traders don’t need to fall into the trap of believing that they will be the ones to get lucky with the next big cryptocurrency.