In the world of finance, the concept of digital assets has gained substantial attention in recent years. One of the main ways that these assets are created and managed is through a process known as mining. This form of mining involves solving complex mathematical problems that verify and add transactions to a decentralized digital ledger. In this post, we will dive into the world of mining, its purpose, and the technology that powers it, as well as the economic implications and challenges involved.

The Process Behind Mining Digital Assets

Mining digital assets can seem like a complex process at first glance, but understanding its underlying mechanisms can simplify the concept. At its core, mining is the method through which new coins or tokens are generated and transactions are validated within a digital network.

What Happens During Mining?

During mining, participants—often referred to as miners—use powerful computers to solve mathematical problems. These problems are part of a verification process that ensures the legitimacy of transactions. Each time a problem is solved, the miner successfully adds a new block of data to the digital ledger, which is also known as the blockchain.

This entire process is decentralized, meaning there is no central authority overseeing it. Instead, miners across the globe work independently but collaboratively to validate transactions and maintain the integrity of the digital network. To incentivize participation, miners are rewarded with newly minted digital assets or transaction fees. You can also explore Immediate Code for further information.

How Are Transactions Verified?

When a user sends a transaction within the network, that transaction is broadcast to the entire network of miners. Miners then compete to solve the mathematical problem tied to that transaction, which typically involves hashing functions. A hash is a unique string of characters created from the data in the transaction, and miners try to find a value that matches a specific target set by the system. The first miner to successfully solve the problem is rewarded and the transaction is confirmed and added to the ledger.

The difficulty of these mathematical problems increases over time, ensuring that the creation of new tokens is gradual and controlled. This is why mining can be computationally intense and requires substantial energy resources.

The Role of Technology in Mining

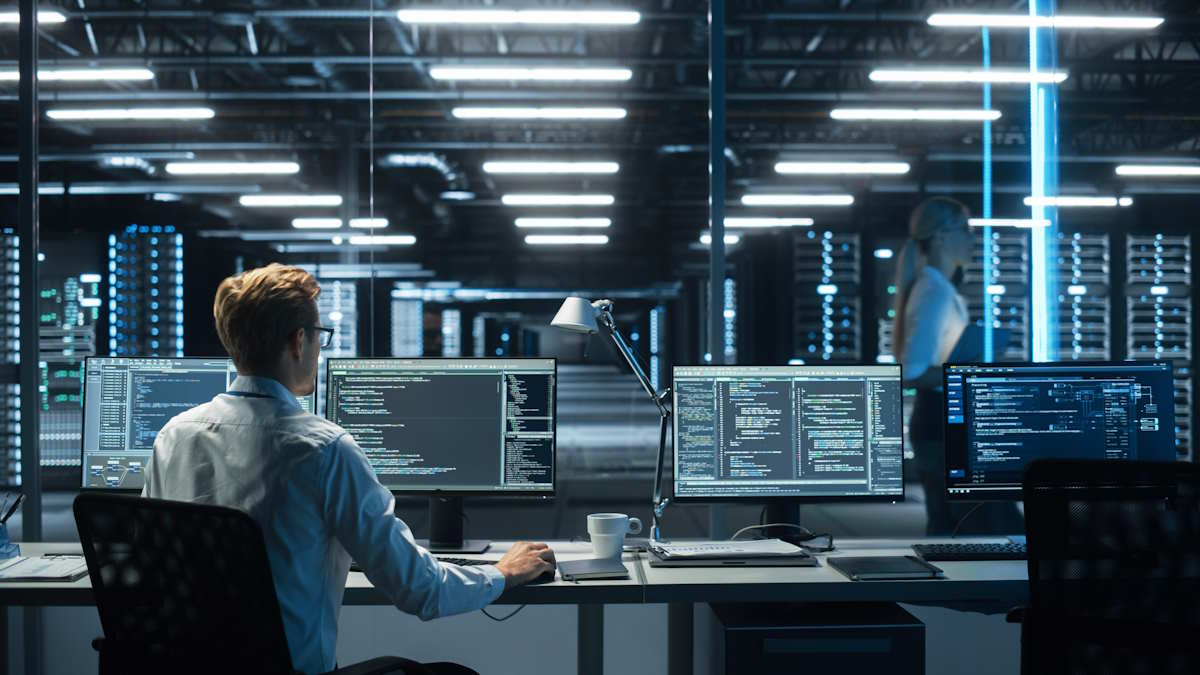

The success of mining relies heavily on the technological infrastructure used to execute these complex tasks. Mining operations typically involve specialized hardware that is capable of performing billions of calculations per second.

Mining Hardware

The hardware used in mining varies based on the complexity of the tasks. Initially, individuals could mine using standard personal computers or laptops. However, as the difficulty of mining has increased, miners have turned to more powerful hardware solutions.

- Graphics Processing Units (GPUs): These are widely used in mining as they can handle parallel processing tasks more efficiently than traditional CPUs.

- Application-Specific Integrated Circuits (ASICs): ASICs are custom-built machines designed specifically for mining. They are far more efficient than GPUs and CPUs but come with a higher upfront cost.

- Field-Programmable Gate Arrays (FPGAs): These offer a balance between the flexibility of GPUs and the efficiency of ASICs, allowing miners to adjust hardware configurations as needed.

Mining equipment is typically housed in large data centers or “mining farms,” where large numbers of machines work in parallel to maximize the chances of solving mathematical problems and earning rewards.

Software and Algorithms

In addition to specialized hardware, mining requires sophisticated software to manage the mining process. These mining programs interface with the blockchain network and relay necessary data, such as transaction information and the current state of the network. Some miners use mining pools—groups of miners who combine their computational power to increase the probability of solving a problem and earning rewards.

The algorithms governing mining also vary between different networks, with each blockchain using different consensus mechanisms to validate transactions. Popular methods include Proof of Work (PoW), Proof of Stake (PoS), and more recently, hybrid systems that combine different approaches for added security and efficiency.

The Economic Impact of Mining

Mining plays a crucial role in the economy of digital assets. Not only does it create new coins and validate transactions, but it also drives demand for specialized hardware, electricity, and infrastructure. This makes mining both a profitable venture and an energy-intensive activity.

The Cost of Mining

The profitability of mining largely depends on the cost of electricity and the efficiency of the hardware being used. Mining can consume vast amounts of energy, particularly in large mining operations. This has sparked a debate about the environmental impact of mining, especially in regions where electricity is generated through non-renewable sources.

Despite the high energy consumption, mining can still be profitable if managed well. Efficient miners are always looking for ways to reduce electricity costs, such as locating mining operations in areas with cheaper or renewable energy sources.

Mining as an Investment

For many, mining has become a viable investment strategy. Miners can generate income by selling the rewards they earn from successfully mining transactions. However, the value of these rewards fluctuates with market demand, making mining a risky investment. Factors such as network difficulty, hardware costs, and energy prices must be carefully considered to assess the overall profitability of a mining operation.

Some mining enthusiasts also invest in mining equipment with the hope that the value of the digital assets they mine will increase over time. This makes mining a speculative venture, as the price of digital assets can rise or fall based on a range of factors, including market trends, regulatory changes, and technological advancements.

Challenges and Future of Mining

While mining has become an integral part of the digital asset ecosystem, it is not without its challenges. From environmental concerns to the increasing complexity of mining algorithms, miners must navigate numerous obstacles to remain competitive.

Environmental Concerns

One of the most discussed issues surrounding mining is its environmental impact. The high energy consumption of mining operations has raised alarms about its sustainability, especially as global energy consumption continues to rise. In response, some blockchain networks are exploring alternatives like Proof of Stake, which is far less energy-intensive than traditional Proof of Work.

Technological Evolution

As the digital asset industry evolves, mining technology must also keep pace. This means that miners must continually upgrade their hardware and software to stay competitive. This constant need for innovation and investment can make mining an expensive endeavor, which is why it is often more suitable for large-scale operations with significant resources.

Conclusion

In conclusion, mining is a critical component of the digital asset ecosystem, providing a decentralized way to verify transactions and create new tokens. While it is a complex and resource-intensive process, it offers opportunities for those with the right technology and strategy. As the industry continues to grow and evolve, miners will need to adapt to new challenges and technological advancements. Despite its hurdles, mining remains a cornerstone of the digital economy, with a future that is both promising and dynamic.