Ever felt like you’re deciphering ancient hieroglyphics while reading cryptocurrency whitepapers? Or maybe you’re knee-deep in an ICO and the SEC regulations resemble a Rubik’s Cube you can’t solve? You’re not alone. The Wild West of cryptocurrency holds immense potential, but its frontier is riddled with legal complexities that can trip even the most seasoned entrepreneur.

That’s where a crypto lawyer becomes your trusty Stetson and six-shooter. Forget the days of wading through legalese alone. A crypto lawyer, well-versed in the intricate web of regulations, tax laws, and emerging legal precedents, acts as your guide and guardian in the cryptoverse.

Picture this: You’re launching a revolutionary NFT platform. The possibilities are endless, but so are the legal hurdles. From ensuring compliance with securities laws to crafting airtight smart contracts, missteps can be costly, both financially and reputationally. A crypto lawyer would navigate these intricacies with the finesse of a seasoned trailblazer, ensuring your venture stays on the right side of the law.

Here’s why partnering with a crypto lawyer is a no-brainer for your cryptocurrency venture:

- Regulatory Landscape: The crypto space is a regulatory rollercoaster. A crypto lawyer stays ahead of the curve, keeping you informed and compliant with evolving local, national, and international regulations. Think of them as your personal regulatory radar, shielding you from unexpected storms.

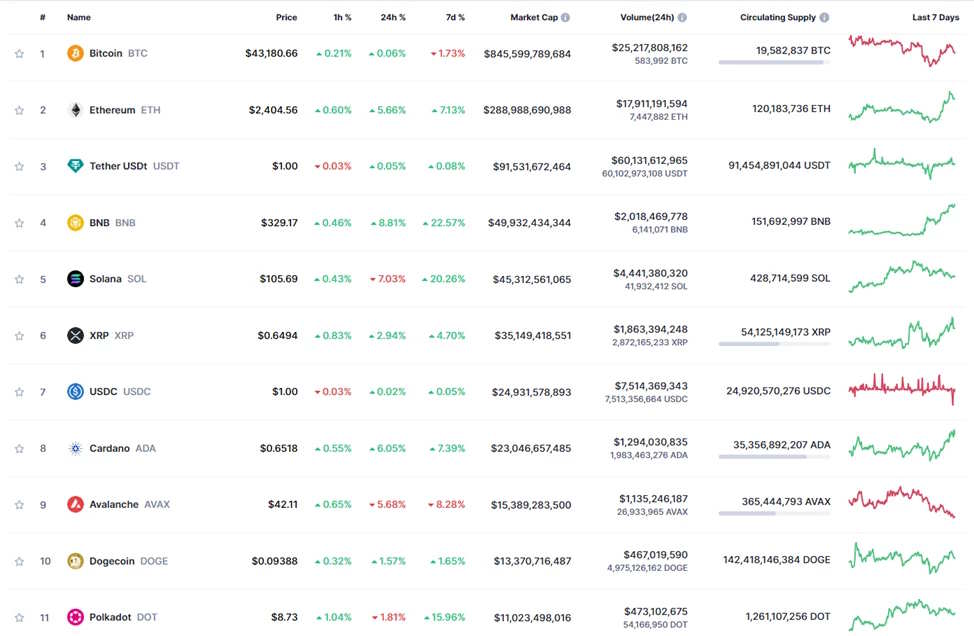

- Tax Implications: Cryptocurrency isn’t just about Lamborghinis; it’s about taxes, too. A crypto lawyer demystifies the complex tax implications of various crypto activities, ensuring you pay your dues without overpaying. They’re your tax translator, deciphering the cryptic code of cryptocurrency taxation.

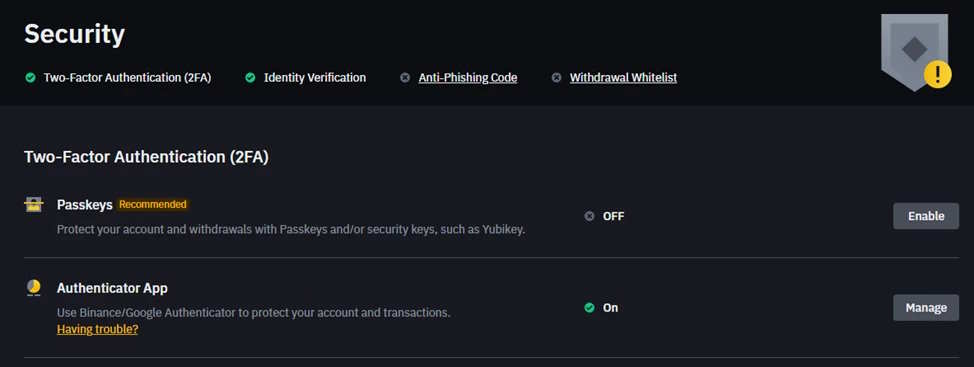

- Smart Contract Security: Smart contracts are the lifeblood of many crypto ventures, but vulnerabilities can leave you exposed. A crypto lawyer audits your smart contracts with eagle eyes, identifying and patching potential security holes before they become costly exploits. They’re your contract code security czar, ensuring your digital agreements are ironclad.

- Dispute Resolution: The crypto world isn’t immune to disagreements. A crypto lawyer has the expertise to navigate complex disputes, be it with investors, partners, or regulatory bodies. They’re your legal gladiator, fighting for your rights in the digital arena.

Investing in a crypto lawyer isn’t just about avoiding trouble; it’s about unlocking opportunities. Their insights can help you structure your venture for maximum legal and financial viability, giving you a competitive edge in the ever-evolving crypto landscape.

Still on the fence? Here are 3 FAQs to ponder:

- Do I really need a crypto lawyer when there are online resources? While online resources offer valuable information, they can’t replace the personalized guidance and legal expertise of a crypto lawyer. Every venture is unique, and legal nuances can have significant consequences. Consider a crypto lawyer as your investment in peace of mind and legal soundness.

- Can’t I just hire a regular lawyer? While traditional lawyers understand legal principles, they might not have the specialized knowledge of cryptocurrency regulations and technology. A crypto lawyer stays ahead of the curve in this rapidly evolving field, ensuring your venture operates within the specific legal framework of the crypto space.

- How much does a crypto lawyer cost? Fees vary depending on the lawyer’s experience, the complexity of your venture, and the scope of services required. However, remember that the cost of a potential legal misstep can far outweigh the investment in a crypto lawyer’s expertise. Consider it an insurance policy for your venture’s legal well-being.

Don’t let legal complexities stall your crypto dreams. Partner with a crypto lawyer and venture into the future with confidence. Your success story in the cryptoverse awaits!