In today’s fast-paced world where time has become our most precious resource, people are seeking effective ways to maintain their health without leaving home. Weight management has become particularly relevant, requiring a systematic approach and professional support. Digital technologies have opened new possibilities for those who want effective routines for weight loss but cannot visit a physical gym.

The Growing Trend of Online Fitness

The digital fitness industry is experiencing unprecedented growth. According to research, the online fitness market has grown by 45% over the past two years, significantly outpacing the growth rate of the traditional fitness industry. This surge is explained not only by pandemic aftereffects but also by the general trend toward digitalization.

Another important fact is that people who use online personal training services show 37% better adherence to their fitness programs compared to those who exercise independently. The accountability factor proves critical for achieving sustainable results.

Key Statistics:

- 78% of fitness enthusiasts now use at least one digital fitness solution

- The average retention rate for online personal training is 6.8 months versus 2.3 months for self-guided programs

- 62% of people cite time constraints as their main barrier to traditional gym attendance

Real-Life Success Stories

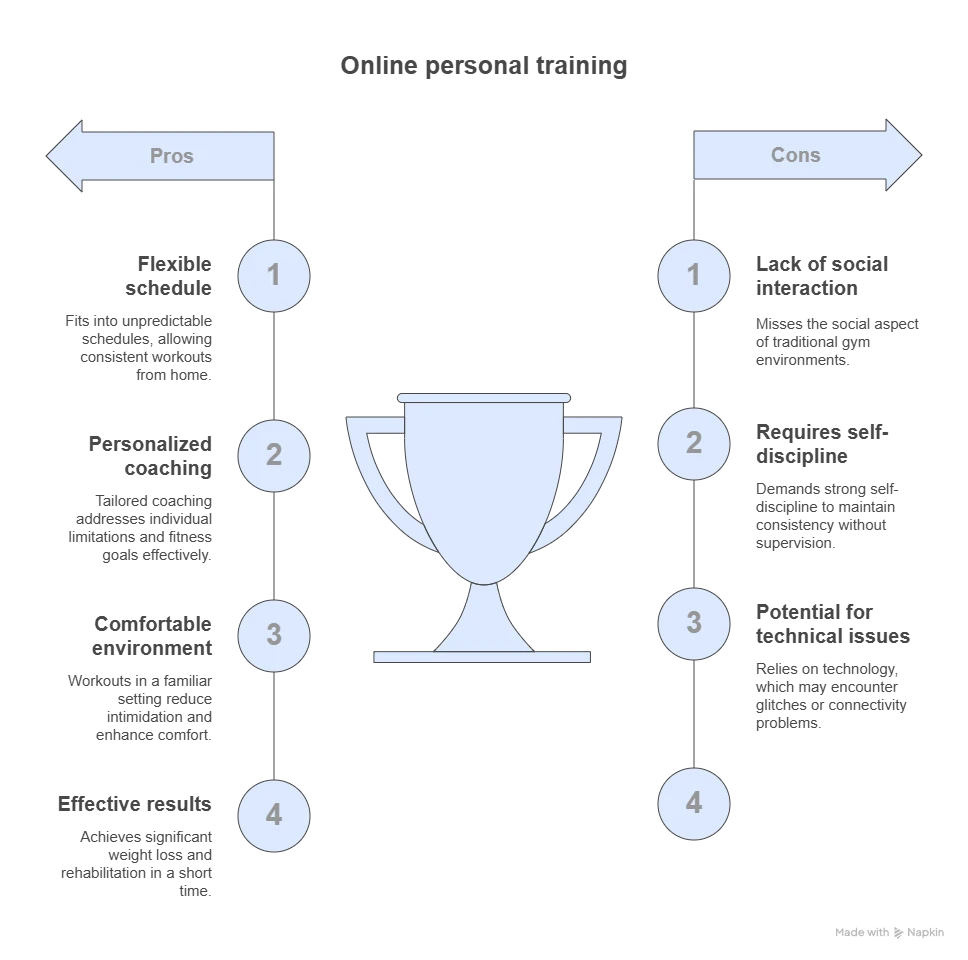

Consider Sarah, a 42-year-old marketing executive and mother of two who struggled with post-pregnancy weight for years. “I tried countless gym memberships but could never maintain consistency due to my unpredictable schedule,” she shares. After switching to online personal training, Sarah lost 28 pounds in six months while working out just three times weekly from her living room.

Similarly, Michael, a 55-year-old recovering from knee surgery, found traditional gym environments intimidating and potentially harmful. Through specialized online coaching, he not only rehabilitated his knee but also lost 15 pounds of excess weight. “The ability to have a trainer who understands my limitations but still pushes me appropriately has been transformative,” he explains.

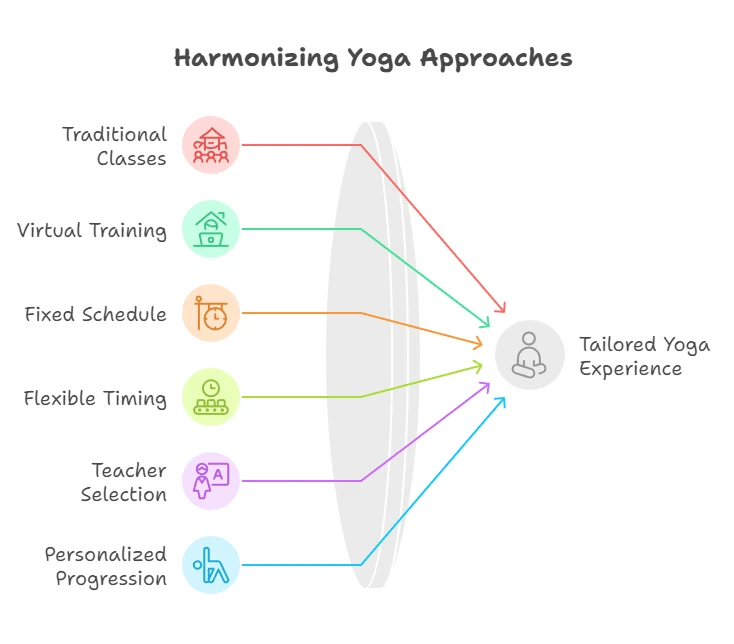

Finding the Right Online Solution

While exploring weight loss options, many people encounter obstacles like lack of personalization or difficulty maintaining motivation. Mywowfit addresses these challenges through one-on-one video training sessions with certified professionals. What sets quality online training apart is the ability to receive real-time feedback and corrections, just like in in-person sessions.

It’s worth noting that online fitness platforms vary significantly in quality and approach. Some focus purely on workout videos without interaction, while others, like Mywowfit, prioritize personalized guidance and accountability. The most effective solutions combine exercise programming with nutritional guidance and progress tracking.

Of course, online training has certain limitations—trainers cannot physically adjust your form or provide hands-on assistance. However, quality platforms compensate with multiple camera angles, detailed verbal cues, and specialized coaching techniques developed specifically for remote instruction.

Implementing an Effective Online Training Routine

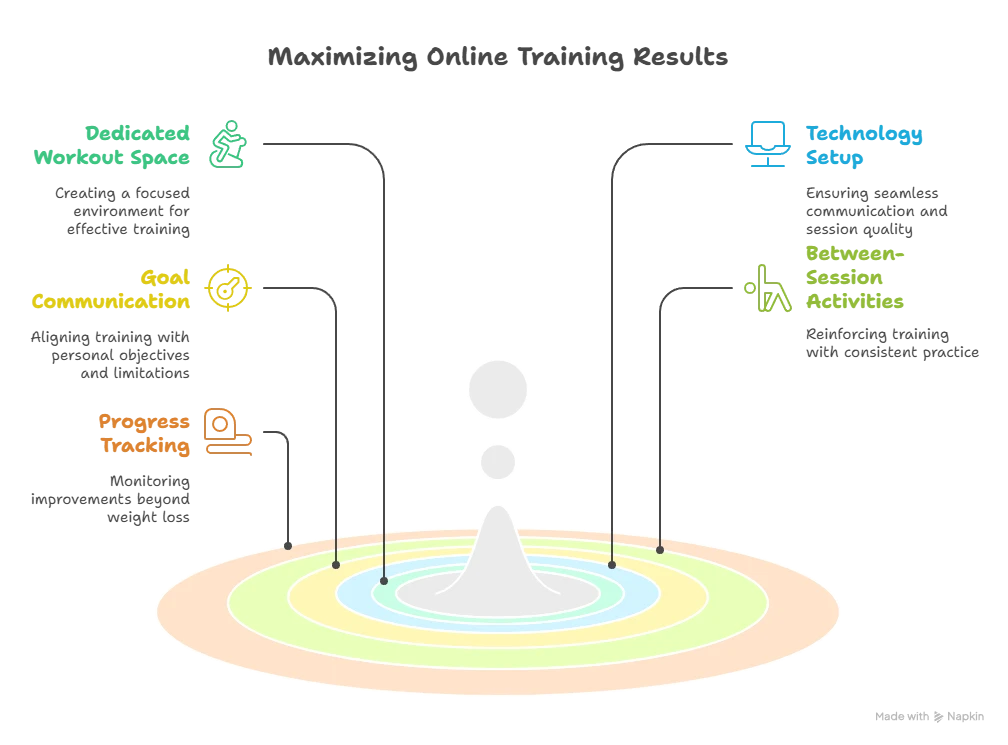

How to Maximize Results with Online Personal Training:

- Create a dedicated workout space, even if small (6×6 feet is sufficient)

- Test your technology setup before your first session

- Communicate specific goals and limitations to your trainer

- Follow through with recommended between-session activities

- Track progress through measurements beyond just weight

As Dr. Jennifer Roberts, sports medicine specialist at Columbia University, notes: “The effectiveness of exercise doesn’t depend on location but rather on proper form, appropriate intensity, and consistency—all of which can be achieved through well-designed online training programs.”

Similarly, celebrity trainer Marcus Thompson observes: “The most significant advantage of online training is the elimination of barriers. When your trainer is accessible from anywhere, excuses disappear and consistency becomes much easier to maintain.”

Frequently Asked Questions

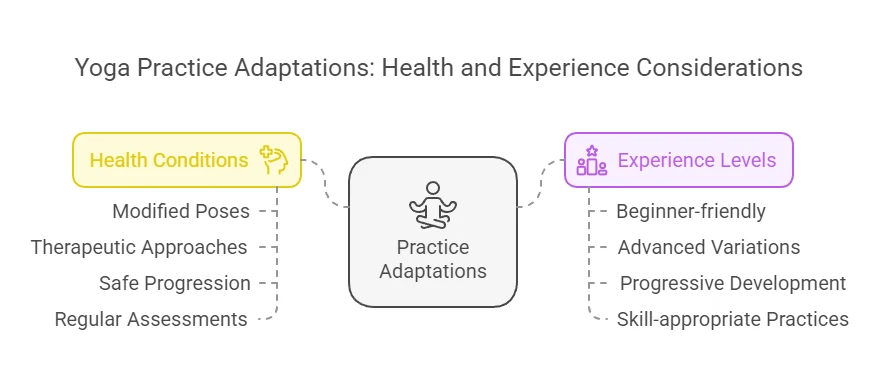

Do I need special equipment for online training? Most programs require minimal equipment to start—often just your body weight, though resistance bands or light dumbbells may enhance results.

How do trainers correct form through video? Professional online trainers use specific verbal cues, request multiple angles, and utilize visual demonstrations to ensure proper technique.

Is online training effective for significant weight loss? Yes, research shows comparable results between online and in-person training when following a structured program with accountability components.

Can online training accommodate injuries or health conditions? Qualified trainers can modify exercises for various conditions, though medical clearance is recommended for specific health concerns.

How often should I train online for weight loss results? Most successful clients achieve results with 3-4 sessions weekly, combined with independent activity.

Will I receive nutritional guidance as well? Comprehensive services include nutritional recommendations, though the level of detail varies by platform and trainer certification.

How quickly can I expect to see results? Most clients notice initial changes within 4-6 weeks, with more substantial results at the 3-month mark.

Conclusion

The landscape of fitness has fundamentally changed, with online personal training emerging as a convenient, effective solution for weight loss and overall health improvement. By combining technological advantages with human expertise, these services deliver accountability, personalization, and flexibility previously unavailable to most people.

For those considering their next steps in fitness, exploring online options may provide the sustainable approach needed for long-term success. Additional resources like fitness tracking apps, nutrition planning tools, and Online personal training prices can further enhance your journey.

Comparison of Weight Loss Solutions

| Feature/Characteristic | Mywowfit | Self-Guided Apps | Traditional Gym |

|---|---|---|---|

| Personalized Programming | Custom workouts tailored to individual needs | Generic templates with minor customization | Personalized only with paid PT sessions |

| Real-time Feedback | Live corrections during video sessions | None or AI-based only | Available only during in-person sessions |

| Scheduling Flexibility | Available early morning to late evening, 7 days/week | Complete flexibility (anytime) | Limited to gym operating hours |

| Equipment Required | Minimal or none | Varies by program | Full gym access |

| Cost Effectiveness | Moderate investment with high accountability | Lowest initial cost but lower completion rates | Highest cost when including membership + PT |